In an intriguing turn of events, Tesla finds itself at the epicenter of financial speculation yet again. According to Hazeltree, a renowned data and tech firm, Tesla (TSLA) has been crowned as the most-shorted large-cap stock in the United States for May 2024. This ranking comes courtesy of Hazeltree's proprietary Crowdedness Score, a metric designed to reveal which securities are being shorted by the highest percentage of funds within its community. Tesla received the highest possible score of 99, essentially making it the prime target for short-sellers.

The Crowdedness Score from Hazeltree is a fascinating analytics tool. Securities are ranked on a scale from 1 to 99, with 99 signifying maximum short-selling activity. As of this report, Tesla has secured the dubious top spot, a position that speaks volumes about investor sentiment and the challenges facing Elon Musk's pioneering venture. This data is aggregated from the firm's proprietary finance platform, which keeps tabs on approximately 15,000 global equities, sourced from a behemoth pool of around 700 asset manager funds worldwide.

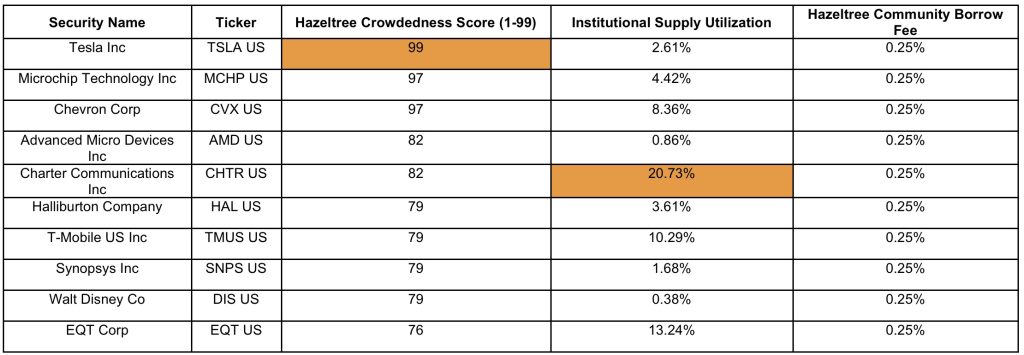

Not far behind Tesla in this ranking are other corporate giants. Microchip Technology Inc. and Chevron Corp. both hold a crowdedness score of 97, marking them as significant players in the short-selling landscape. Following these are Advanced Micro Devices Inc. (AMD) and Charter Communications Inc., each carrying a crowdedness score of 82. This collection of heavyweights underscores a broader market trend where high-profile entities are increasingly under the microscope of critical investors.

The underlying data providing substance to Hazeltree's findings comes from one of the most sophisticated securities finance platforms in existence. By leveraging the insights from a community of 700 asset manager funds, Hazeltree's platform is able to track, aggregate, and anonymize the shorting activity across a stunning array of global equities spread through the Americas, EMEA, and APAC regions.

Amidst all this information, Tesla's upcoming 2024 Annual Stockholders’ Meeting on June 13 looms large. Set against a backdrop of increased short-selling activity, the meeting's agenda includes critical proposals such as the ratification of Elon Musk’s 2018 CEO Performance Award and a significant vote on the proposed redomestication of Tesla's headquarters from Delaware to Texas. With Tesla's stock currently hovering around $169.32 per share, reflecting a market cap of $539 billion, investor decisions during this meeting could dramatically reshape the company’s trajectory.

For those who wish to dive deeper into the intricacies of the Hazeltree Crowdedness Score and the broader short-selling landscape of May 2024, the complete May 2024 Hazeltree Shortside Crowdedness Report is readily accessible. Such insights are invaluable for understanding the mechanics driving investor behaviors and the market forces at play.

The dynamic between Tesla and its critics is as volatile as ever. With discussions about Elon Musk's compensation package and the strategic relocation of the company, all eyes are fixed on how Tesla maneuvers through these challenges. While the road ahead is uncertain, what's clear is that Tesla's narrative continues to captivate and divide market watchers and investors alike.

Stay in the loop with the latest developments by subscribing to Super Veloce newsletter, and if you have any news tips, don't hesitate to reach out at tips@superveloce.com.