Tesla enthusiasts were taken by surprise on Thursday night when the price of the Model 3 Performance saw an unexpected $1,000 increase, climbing from $53,990 to $54,990. This recent hike marks yet another shift in Tesla's pricing strategy, which has become infamous for its unpredictability.

Originally launched on April 23, the new Model 3 Performance debuted at $52,990, flaunting impressive specs including a top speed of 163 MPH and a breathtaking 0-60 MPH acceleration time of just 2.9 seconds. It had already experienced a price bump to $53,990 just days later, displaying Tesla's habit of adjusting prices based on market dynamics and internal goals. Now, with the latest increase pushing it to $54,990, many are left wondering what the future holds for Tesla pricing.

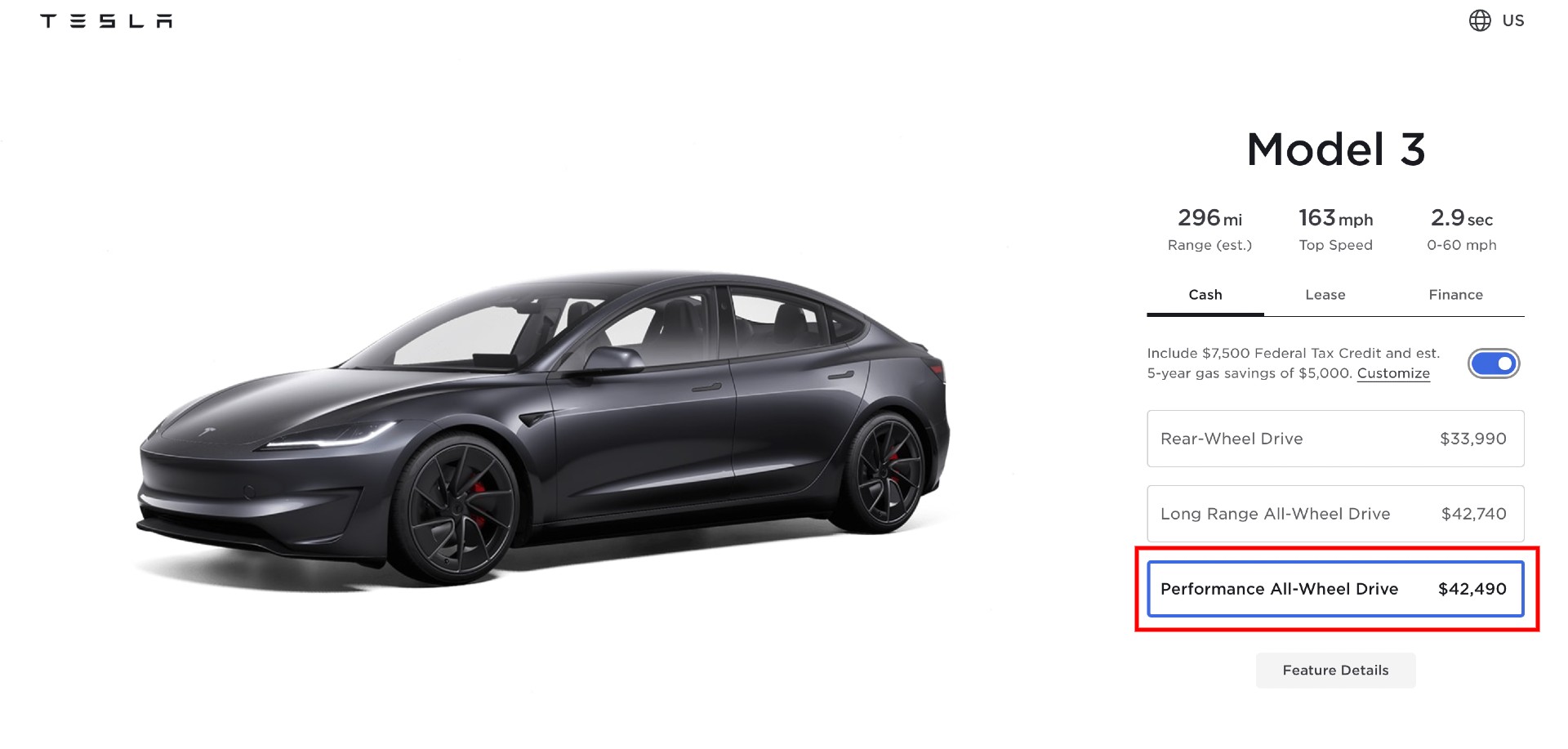

Despite the higher cost, the Model 3 Performance still qualifies for the $7,500 federal tax credit, which, combined with Tesla’s estimate of $5,000 in gas savings over five years, brings the effective cost down to a more palatable $42,490. However, these calculations are based on ideal conditions and may vary depending on actual usage and local incentives.

Tesla Model 3 Performance price hike" />

Tesla Model 3 Performance price hike" />Interior Option Price Changes

The price hike wasn't limited to just the base price of the Model 3 Performance; several interior options underwent adjustments too:

- White Interior for Model 3 Rear-Wheel-Drive now costs $2,000, up by $500.

- White Interior for Model 3 Long Range is also up by $500, costing now $2,000.

Interestingly, the price of the White Interior option for the Model 3 Performance has been decreased to no extra cost. This move likely ensures that the Model 3 Performance remains eligible for the EV tax credit, thereby keeping it competitive in the electric vehicle market.

Tesla's Strategy Behind Price Increases

Tesla's strategy of increasing prices is aimed at maintaining its robust gross margins, which have historically been some of the strongest in the automotive industry. Last year, the company faced investor concerns when it slashed prices to boost demand, thereby putting pressure on its profit margins. Investors are wary that aggressive price cuts, although beneficial for boosting demand, can hurt the stock price and overall financial health of the company.

On the flip side, Tesla must tread carefully to balance affordability and profitability. Lowering prices too much risks eroding margins, while increasing them too steeply could alienate potential buyers. Tesla's recent moves suggest a tightrope act where the goal is to bring EVs to a price point accessible to the average consumer without compromising the company’s financial stability.

It's worth noting that this latest price increase might be the last one for the Model 3 Performance, as it now hovers just below the $55,000 threshold required for the EV tax credit. Going above this limit would eliminate a significant financial incentive for buyers, potentially dampening demand.

Stay tuned as we continue to monitor Tesla's ever-evolving pricing strategies, providing you with the latest updates and insights into how these changes might affect your next EV purchase.