Tesla's Future Valuation Skyrockets: ARK Invest's Bold Projections & The Missing Factors

In a recent turn of events, Tesla has received an exuberant price target from Cathie Wood and her team at ARK Invest, sparking much excitement and speculation. According to ARK's latest projection report, Tesla's stock could swell to an astonishing $2,600 per share, with an optimistic scenario reaching $3,100 and a conservative one at $2,000.

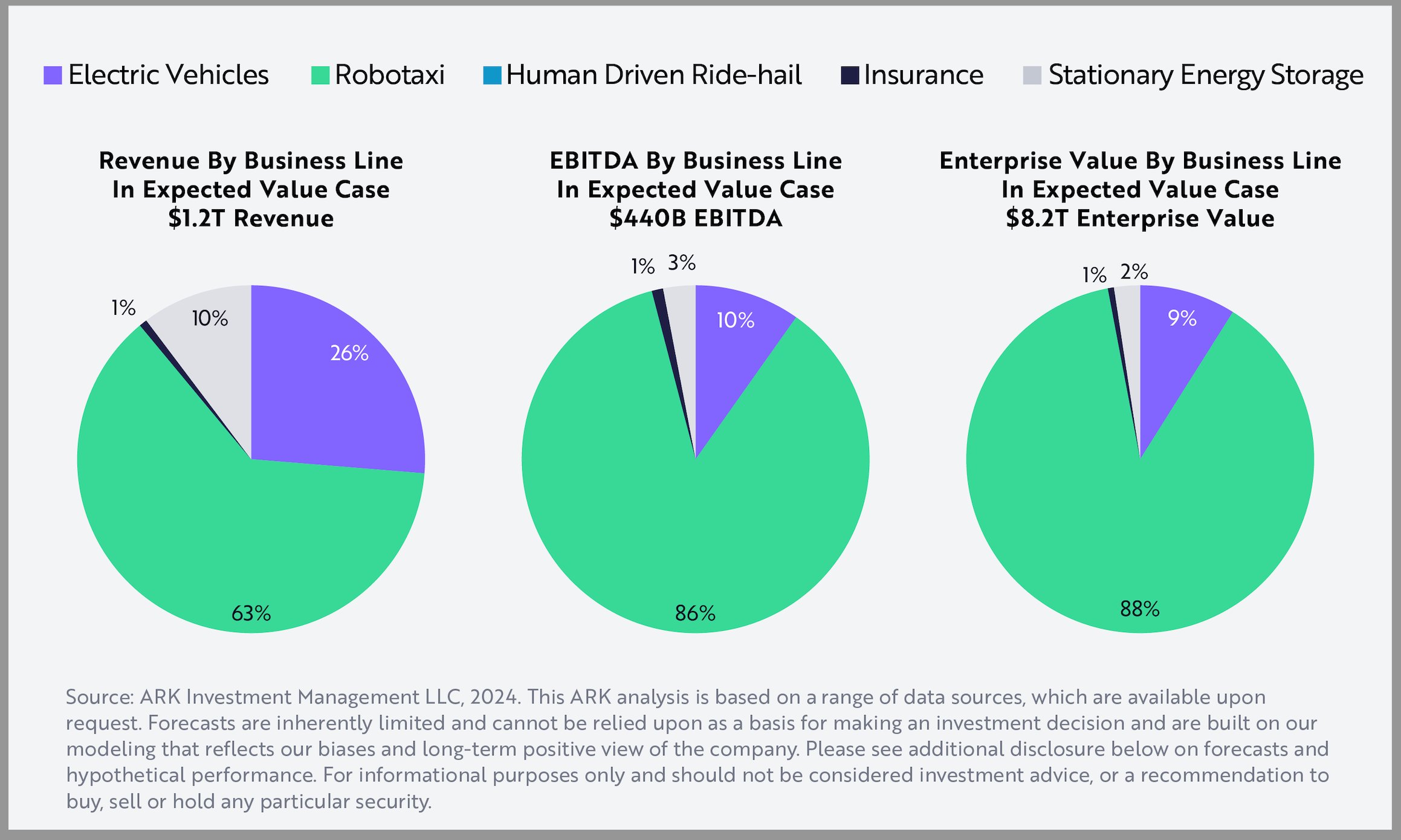

This latest analysis heavily leans on the potential of Tesla's burgeoning robotaxi business. ARK’s forecast posits that nearly 90% of Tesla's future earnings and enterprise value by 2029 will stem from its robotaxi operations. In contrast, the electric vehicle (EV) segment is projected to account for about one-quarter of total sales and roughly 10% of Tesla's earnings. The higher margins from the robotaxi business are expected to significantly outpace those from traditional EV sales, as detailed in ARK's breakdown of attributable revenue, EBITDA, and enterprise value by business line.

The Unconsidered Optimus Factor

Interestingly, ARK Invest has decided to adopt a conservative approach by not including the potential impact of Tesla’s developing Optimus Bot in their model. Despite its exclusion, the Optimus Bot, currently being operationally tested at the Gigafactory Texas, holds promising future prospects. Tasha Keeney from ARK Invest highlighted on social media:

“We conservatively assumed that Tesla does not sell Optimus externally in our model, and that Optimus manufacturing savings modestly impact Tesla’s costs in single-digit percentages over the next five years.”

In their report, ARK broadens this view by stating, “We assume that Optimus will have minimal impact on our price target. Over the next decade, we expect Tesla to become a leading manufacturer and service provider of robots that navigate physical space, leveraging the Tesla robotaxi experience and its in-house tech innovations.” If Optimus reaches its potential and can offset 10-20% of Tesla's labor with productivity doubling that of human workers, it could yield substantial manufacturing savings, projected between $3-4 billion by 2029.

The Dominance of Robotaxi in Tesla's Future

The crux of ARK’s extensive analysis underscores Tesla’s robotaxi initiative as the primary driver of future value. Graphs and models presented by ARK highlight the overwhelming contribution of robotaxi to revenue, EBITDA, and enterprise value:

Overlooked Factors and Their Potential Impacts

There are notable elements ARK decided to leave out, which could have game-changing implications for Tesla’s future:

- Tesla Semi: Despite its industry-altering potential, ARK does not foresee the Tesla Semi significantly enhancing the company’s valuation within the next five years.

- Supercharging Network: While Superchargers are vital to Tesla’s EV ecosystem, ARK projects that they won't generate significant revenue.

- Full Self-Driving (FSD) Licensing: The possibility of licensing Tesla's FSD software to other automakers is not expected to come to fruition within the five-year outlook.

- AI-As-A-Service: The prospects of Tesla offering AI-inference-as-a-service or utilizing its Dojo training-as-a-service are considered outside the near-term horizon.

To read the comprehensive report from ARK Invest, click here.

If you have any thoughts or questions, feel free to reach out via email at [email protected] or find me on Twitter at @KlenderJoey. For news tips, drop an email to [email protected].